California is cracking down on corporate climate accountability, and businesses must act fast to achieve California climate disclosure compliance. Two game-changing laws, Senate Bill 253 (SB 253) and Senate Bill 261 (SB 261), are forcing large companies to report greenhouse gas (GHG) emissions and climate-related financial risks. With deadlines looming in 2026, non-compliance could mean hefty fines, legal trouble, and a trashed reputation. Fortunately, this guide breaks down the requirements and provides a clear, five-step plan to get your business audit-ready, before it’s too late.

Act Now: Decode SB 253 and SB 261 Requirements

SB 253: Your Emissions Reporting Wake-Up Call

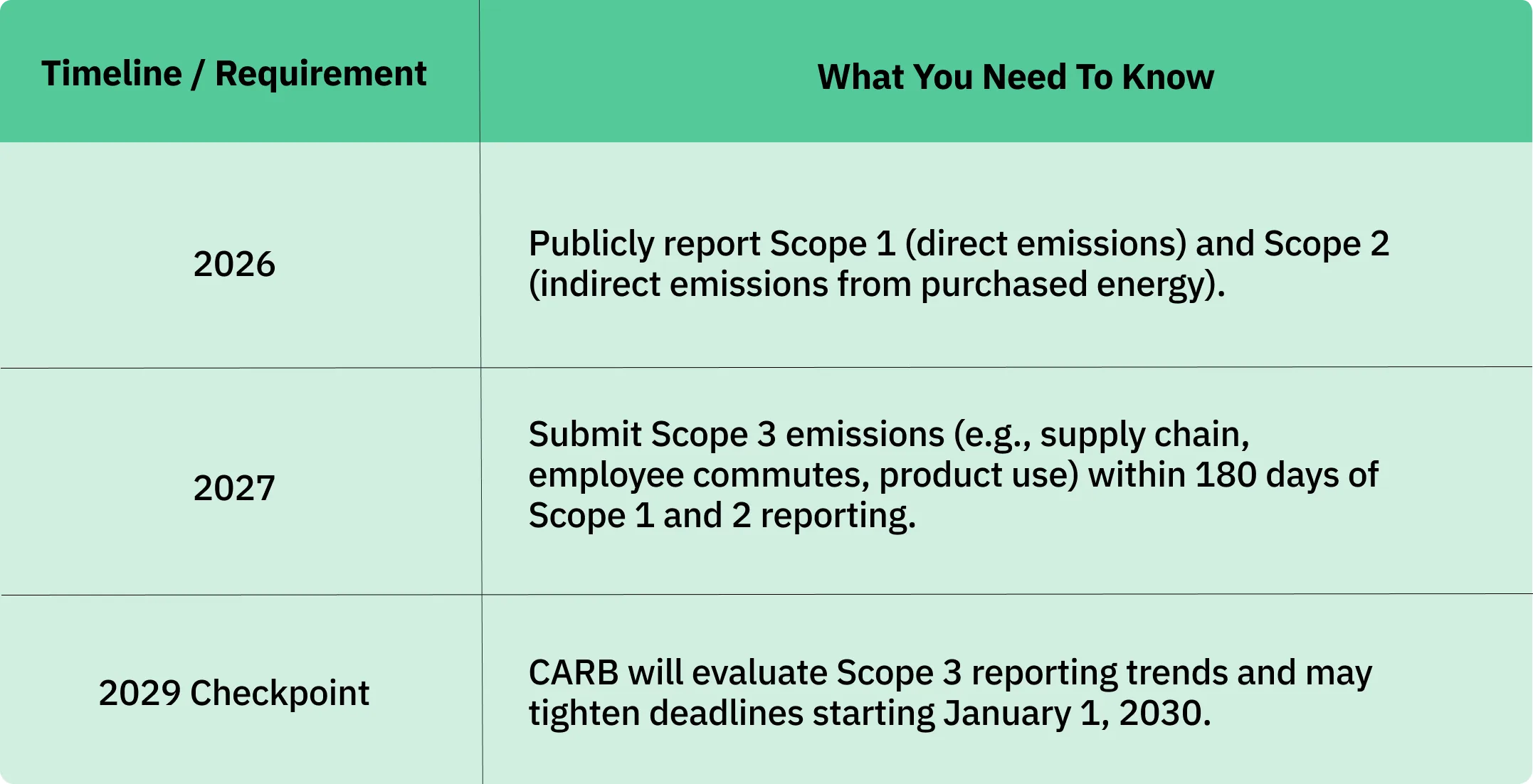

Signed into law on October 7, 2023, SB 253 targets businesses with over $1 billion in annual revenue operating in California. It demands full disclosure of Scope 1, Scope 2, and Scope 3 GHG emissions. Here’s the urgent timeline:

Annual disclosures are non-negotiable, with third-party assurance to verify your data.

Scope 1 and Scope 2 assurance starts at a limited level in 2026, ramping up to reasonable assurance by 2030. Scope 3 assurance may kick in by 2027, effective 2030 at a limited level.

Costs and Consequences

You’ll pay an annual fee to CARB, deposited into the Climate Accountability and Emissions Disclosure Fund. Moreover, failing to comply could slap you with penalties up to $500,000 per year, though good-faith efforts may soften the blow.

SB 261: Don’t Ignore Climate Financial Risks

Meanwhile, SB 261 applies to businesses with over $500 million in annual revenue in California. Starting January 1, 2026, you must report climate-related financial risks every two years, following the Task Force on Climate-related Financial Disclosures (TCFD) framework or similar standards.

For instance, this includes physical risks (like wildfire damage) and transition risks (like costs of shifting to green energy), plus your plans to tackle them.

Dodge the Fallout: Risks of Ignoring Compliance

Failing to achieve California climate disclosure compliance is a high-stakes gamble.

- Fines under SB 253 can hit $500,000 annually for missing reports, late submissions, or other violations. While Scope 3 errors made in good faith are penalty-free until 2030, non-filing penalties start in 2027.

- Legal risks loom large, with California’s Attorney General shaping enforcement, which could lead to lawsuits or regulatory headaches.

- Reputational damage is a real threat. In today’s market, investors and customers demand transparency. Falling short could tank your brand’s trust and market edge.

Why Compliance Feels Like Climbing Everest

Gathering data for California climate disclosure compliance is no walk in the park. For example, collecting and auditing Scope 1, Scope 2, and Scope 3 emissions can take months, especially Scope 3, which involves untangling your supply chain.

Without the right tools, you’re risking errors, missed deadlines, or a frantic last-minute rush. Additionally, third-party assurance requires coordinating with qualified providers, who may be stretched thin as deadlines approach. The complexity makes starting early a must.

Your 5-Step Battle Plan to Crush Compliance

To nail California climate disclosure compliance by 2026, act now with this straightforward five-step plan:

Step 1: Size Up Your Obligations (Q1 2025)

Don’t wait: check if your business hits SB 253 ($1B+ revenue) or SB 261 ($500M+ revenue) thresholds. Specifically, review your California operations and last year’s revenue. Then, loop in your legal and sustainability teams to pinpoint which entities in your company need to report. Clarity now saves headaches later.

Step 2: Build Your Data Machine (Q2-Q3 2025)

Next, set up a system to collect Scope 1, Scope 2, and Scope 3 emissions data, following the Greenhouse Gas Protocol standards. Similarly, for SB 261, map out climate risks using the TCFD framework. Invest in software to streamline data from your operations, suppliers, and value chain. Since Scope 3 often involves external partners, start these conversations early to avoid bottlenecks.

Step 3: Lock In Assurance Partners (Q4 2025)

Time is ticking—secure third-party assurance providers with expertise in GHG emissions and climate risk reporting. For SB 253, ensure they meet CARB’s standards for Scope 1 and Scope 2 assurance by 2026, and Scope 3 by 2030. For SB 261, confirm TCFD alignment. Because provider availability may be tight, lock them in early to stay ahead.

Step 4: Test and Tweak Your Process (Q1 2026)

Before the 2026 deadlines, run a trial of your emissions and climate risk reporting. This means checking data accuracy, completeness, and compliance with CARB’s formats. Additionally, conduct an internal audit to spot gaps and fix them fast. This dry run ensures your disclosures are bulletproof and penalty-proof.

Step 5: File and Stay Sharp (Q2 2026 Onward)

Finally, submit your SB 253 Scope 1 and Scope 2 reports to the emissions reporting organization by CARB’s 2026 deadline, with Scope 3 following in 2027. Likewise, file SB 261 climate risk reports by January 1, 2026, and every two years after. Moreover, keep an eye on CARB’s 2029 Scope 3 review and potential 2033 global standard updates to stay compliant.

Turn Compliance Into Your Secret Weapon

Smart companies are flipping California climate disclosure compliance into a competitive advantage. For instance:

- Win Over Investors: Clear, honest reporting draws in ESG-focused investors, opening doors to capital and boosting your market position.

- Build Customer Loyalty: Public disclosures on a digital platform let consumers make informed choices, strengthening your brand’s trust.

- Spark Innovation: Pinpointing emissions and risks can drive smarter, greener practices, cutting costs and building resilience.

- Lead the Pack: Mastering compliance early sets you apart as a climate leader in California’s powerhouse economy.

Don’t Delay: Start Today

The clock is ticking on California climate disclosure compliance. With 2026 deadlines closing in, you need to move fast to build data systems, secure assurance providers, and test your processes. If you act now, you’ll dodge penalties and position your business as a leader in the race to a net-zero future. Don’t get caught flat-footed—start today and turn compliance into your competitive edge.

Need help making sense of SB 253 and SB 261?

Talk to our climate experts to understand exactly where your business stands in the path to California climate disclosure compliance.

FAQs

Who needs to comply with California’s SB 253 and SB 261?

SB 253 applies to businesses with over $1 billion in annual revenue operating in California, requiring Scope 1, 2, and 3 emissions reporting starting in 2026. Meanwhile, SB 261 targets companies with over $500 million in revenue, mandating climate-related financial risk reports every two years from January 1, 2026.

What are the penalties for missing California climate disclosure deadlines?

Non-compliance with SB 253 can lead to fines up to $500,000 per year for non-filing, late filing, or other violations, starting in 2026 for Scope 1 and 2, and 2027 for Scope 3. Additionally, legal scrutiny and reputational damage could harm your business’s market position and consumer trust.

Why is Scope 3 emissions reporting so challenging?

Scope 3 emissions cover indirect value chain activities, like supplier operations and product use, which are tough to track due to their complexity and reliance on external data. Consequently, gathering accurate data often takes months and requires robust systems and supplier collaboration.

How can businesses prepare for third-party assurance requirements?

Businesses should engage qualified third-party assurance providers by Q4 2025 to verify emissions (SB 253) and climate risk (SB 261) reports. Early engagement is critical, as provider capacity may be limited, and ensuring compliance with CARB and TCFD standards takes time.

Can compliance with SB 253 and SB 261 benefit my business?

Absolutely! By achieving California climate disclosure compliance, businesses can attract ESG investors, build consumer trust through transparent reporting, and drive innovation by identifying emission reduction opportunities. Early adopters gain a competitive edge in California’s massive economy.