India’s capital markets are on the cusp of a major transformation, and sustainability is at the center of it. The Securities and Exchange Board of India (SEBI)’s June 2025 circular marks a pivotal moment for sustainable finance in the country. For the first time, India now has a comprehensive regulatory framework not only for green bonds but also for social bonds, sustainability bonds, and sustainability-linked bonds, collectively referred to as ESG debt securities.

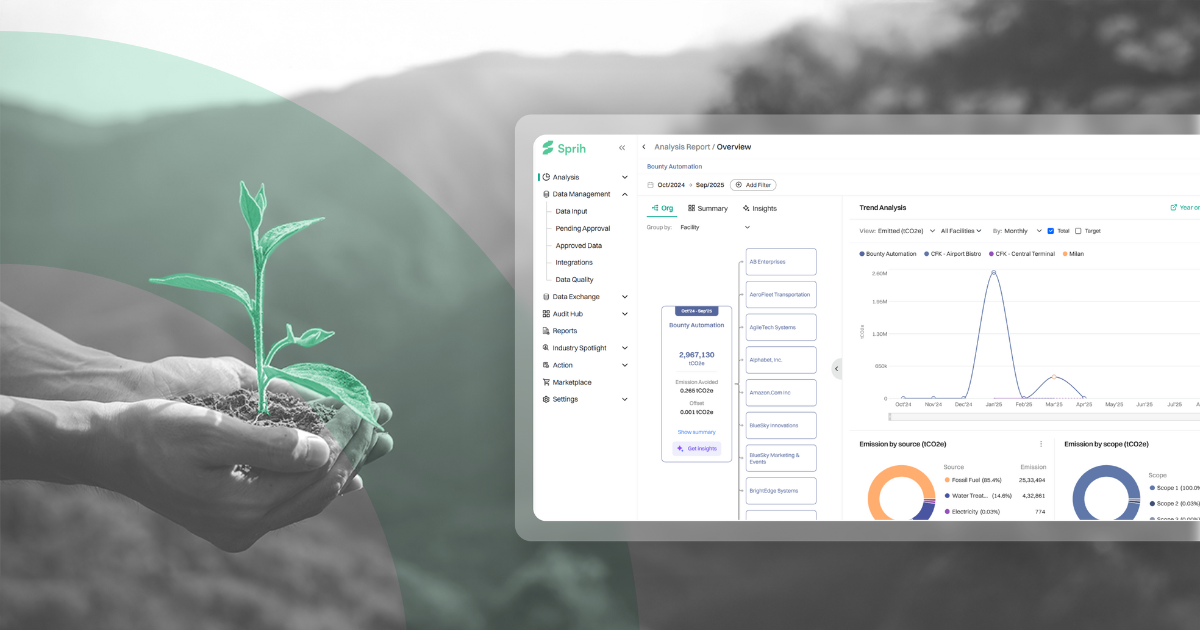

At Sprih, we’ve long believed that sustainability, when approached with rigor and responsibility, can be a long-term business driver. This development is a strong signal that India is moving from ESG intent to ESG action.

But with greater opportunity comes greater responsibility. The new framework opens access to global sustainable capital, but it also raises the bar for transparency, governance, and performance accountability. Here’s what issuers need to know about SEBI’s New ESG Debt Framework:

A Broader ESG Debt Landscape

Until now, regulatory attention largely focused on green bonds. SEBI has now expanded its scope to include:

- Social Bonds: Financing for healthcare, education, affordable housing, food security, and employment generation.

- Sustainability Bonds: Projects combining both green and social objectives.

- Sustainability-Linked Bonds (SLBs): General-purpose bonds tied to achievement of sustainability outcomes (e.g., emission reductions, diversity targets).

Critically, these bonds must align with internationally accepted frameworks like the ICMA Principles, EU Green Bond Standard, or ASEAN Guidelines, with SEBI also open to a future Indian taxonomy.

Why This Matters for Issuers

1. Clarity and Credibility

SEBI’s definitions align with global norms, offering clarity around:

- The use of proceeds

- Eligible project categories

- KPI and SPT expectations (especially for SLBs)

This clarity helps build issuer confidence, reduce interpretational ambiguity, and make Indian ESG bonds more investable for global capital pools.

2. Stronger Governance and Disclosures

Issuers are now required to maintain:

- Documented project selection processes

- Clear alignment with ESG standards

- Public disclosure on fund use, impact metrics, and performance

- For SLBs: Transparent methodologies for KPIs, SPTs, and progress tracking

These disclosures go beyond marketing, they are about building trust with investors. An auditable, data-driven approach is no longer a nice-to-have; it’s a requirement.

At Sprih, we help issuers set robust sustainability targets and establish performance tracking systems that support compliance while building long-term business resilience.

3. Mandatory Third-Party Verification

Every ESG bond now requires validation from an independent external reviewer, whether it’s a second-party opinion provider, external verifier, or SEBI-accredited ESG rating agency.

For SLBs, reviewers must also evaluate whether KPIs are ambitious, material, and measurable. This enhances market integrity but can increase the compliance load if not managed well.

The question then becomes: How do you ensure audit readiness without increasing operational complexity?

Our answer lies in a blend of deep sustainability expertise and intuitive technology, a system that aligns with SEBI’s framework and scales with your ESG ambitions.

4. Guardrails Against Purpose-Washing

SEBI has gone a step further by embedding safeguards to maintain the credibility of ESG labels:

- Prohibiting misuse of funds

- Enforcing impact disclosures (including negative externalities)

- Penalizing ESG misrepresentation with early redemption provisions

- Barring selective or misleading data

Purpose-washing is no longer an option. Data quality, transparency, and governance are now strategic imperatives.

Sprih’s platform helps you collect, manage, and validate sustainability data across your operations, so you can focus on delivery, not just disclosure.

Global Alignment, Local Relevance

SEBI’s ESG debt framework mirrors global best practices, especially from the ICMA and EU Green Bond Standards, while preserving flexibility with a principles-based approach.

Notably, SEBI becomes one of the few regulators globally to formalize rules around Sustainability-Linked Bonds, showing India’s regulatory commitment to sustainable transformation.

This opens the door for Indian issuers to tap global ESG capital, and puts non-compliant or ESG-inactive businesses at reputational risk.

Opportunities for Issuers

- Access to ESG Capital: Global investors are actively seeking credible ESG debt opportunities.

- Reputational Strength: Issuing under this framework signals governance maturity and ESG credibility.

- Flexible Financing: SLBs enable general-purpose capital linked to measurable ESG outcomes.

- Global Benchmarking: Issuers can now meet global due diligence expectations without being at a regulatory disadvantage.

Challenges to Prepare For

- Compliance Complexity: Strong internal systems for data, governance, and reporting are essential.

- Reviewer Costs: Independent verification will require budget and time.

- Performance Risk: Missed ESG targets, especially in SLBs, can lead to penalties or reputational damage.

- Impact Measurement: Both positive and negative outcomes must be measured credibly.

Sprih supports you in turning compliance into capability, through expert-led frameworks and integrated sustainability tech.

Strategic Takeaways for Issuers

- Start Early: Identify your eligible projects, define your KPIs, and build internal ESG architecture ahead of issuance.

- Build Governance: Set up ESG committees, invest in performance tracking tools, and align roles and responsibilities.

- Engage the Right Partners: Choose experienced reviewers and advisors who understand both finance and sustainability.

- Be Transparent: Avoid greenwashing or overpromising. ESG credibility is built on honesty, not optics.

- Think Strategically: ESG is no longer a cost center, it’s a growth lever, a risk mitigator, and a source of long-term value creation.

Final Thought

SEBI’s ESG debt framework is not just regulatory evolution, it’s a strategic opportunity. It rewards those who invest early in sustainable transformation and demands accountability from those who don’t.

At Sprih, we believe sustainability leadership is the foundation of business resilience. Whether you’re a first-time issuer or scaling your sustainable finance strategy, whether you are structuring KPIs or managing disclosures, Sprih equips you with the strategy and systems to issue ESG bonds that stand up to global scrutiny.

Let’s make your sustainability vision investable. Connect with our climate experts now.

FAQs

What is SEBI’s new ESG debt framework and why is it important?

SEBI’s June 2025 circular introduces a comprehensive framework for ESG debt securities in India, including green, social, sustainability, and sustainability-linked bonds. It brings regulatory clarity, aligns with global standards, and opens access to sustainable capital for Indian issuers.

What types of bonds are covered under SEBI’s ESG debt framework?

The framework includes green bonds, social bonds (focused on issues like healthcare and housing), sustainability bonds (combining green and social goals), and sustainability-linked bonds (general-purpose bonds tied to ESG performance targets).

What are the new disclosure and governance requirements for issuers?

Issuers must maintain documented project selection processes, disclose fund utilization and impact metrics, align with ESG standards, and transparently report progress on sustainability targets—especially for SLBs. These disclosures aim to enhance credibility and investor trust.

Is third-party verification mandatory under the new framework?

Yes, all ESG bonds require external validation from accredited reviewers. For sustainability-linked bonds, reviewers must assess the relevance, ambition, and measurability of KPIs, ensuring integrity and accountability in ESG claims.

How can issuers prepare for compliance without increasing operational complexity?

Issuers should start early by defining ESG strategies, setting measurable KPIs, and building governance systems. Platforms like Sprih help streamline data management, automate compliance, and ensure audit readiness, reducing the burden on internal teams.