In 2009, Nestlé had a wake-up call. The company had one of the earliest case for early action in sustainability reporting. Having faced intense public scrutiny over its environmental practices, the company sparked widespread discussion and consumer pressure. At the time, the company’s sustainability efforts were confined to conventional CSR. The crisis, however, triggered a strategic overhaul. Nestlé launched a responsible sourcing program, revamped its reporting, and started disclosing environmental and social impacts transparently—long before CSRD existed.

Today, this transformation is a widely cited case study in sustainability reporting for US companies. It’s not because Nestlé acted early, but because they responded strategically to mounting pressure.

As climate disclosure regulations like the EU’s CSRD and California’s SB 253 emerge, the big question is this: will your company act before a crisis or after?

For US companies, the landscape of sustainability reporting is rapidly evolving. With SB 253 on the horizon and the CSRD already in effect for many, understanding the similarities and differences between these standards is no longer optional – it’s a business imperative. In this blog, we will shed light on navigating this complex terrain, offering invaluable insights for companies striving for compliance and competitive advantage.

Decoding the Regulatory Landscape: SB 253 vs. CSRD

California’s SB 253 mandates greenhouse gas (GHG) emissions reporting. It covers Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased energy), and, after a one-year grace period, Scope 3 (indirect value chain emissions). This applies to companies with over $1 billion in annual revenue in California.

The EU’s CSRD (Corporate Sustainability Reporting Directive) takes a broader view. It uses “double materiality”—requiring firms to report both how they affect the environment and how sustainability issues affect them financially. CSRD goes beyond emissions to include diverse ESG topics under the European Sustainability Reporting Standards (ESRS).

While both push for transparency, CSRD’s scope is significantly wider. Compliance with CSRD may cover SB 253 requirements—but not vice versa. Notably, CSRD gives equal weight to environmental, social, and governance (ESG) factors.

Strategic Advantage in Sustainability Reporting

Experts suggest reframing compliance as a strategic tool. By embracing sustainability reporting frameworks like CSRD and SB 253, US companies can gain tangible advantages:

- Operational Efficiency: Environmental audits often uncover inefficiencies and reduce costs.

- Risk Management: Climate and social risks can be anticipated and mitigated.

- Value Creation: Responsible practices appeal to sustainability-focused investors, employees, and customers.

- Supply Chain Resilience: Proactive emissions tracking positions companies as preferred partners for larger buyers.

These benefits extend far beyond basic compliance. Companies that treat reporting as a strategic lever can strengthen brand equity and build long-term resilience.

The Perils of Falling Behind: Risks of Delayed Action in Reporting

Conversely, companies that lag in their sustainability efforts face significant risks:

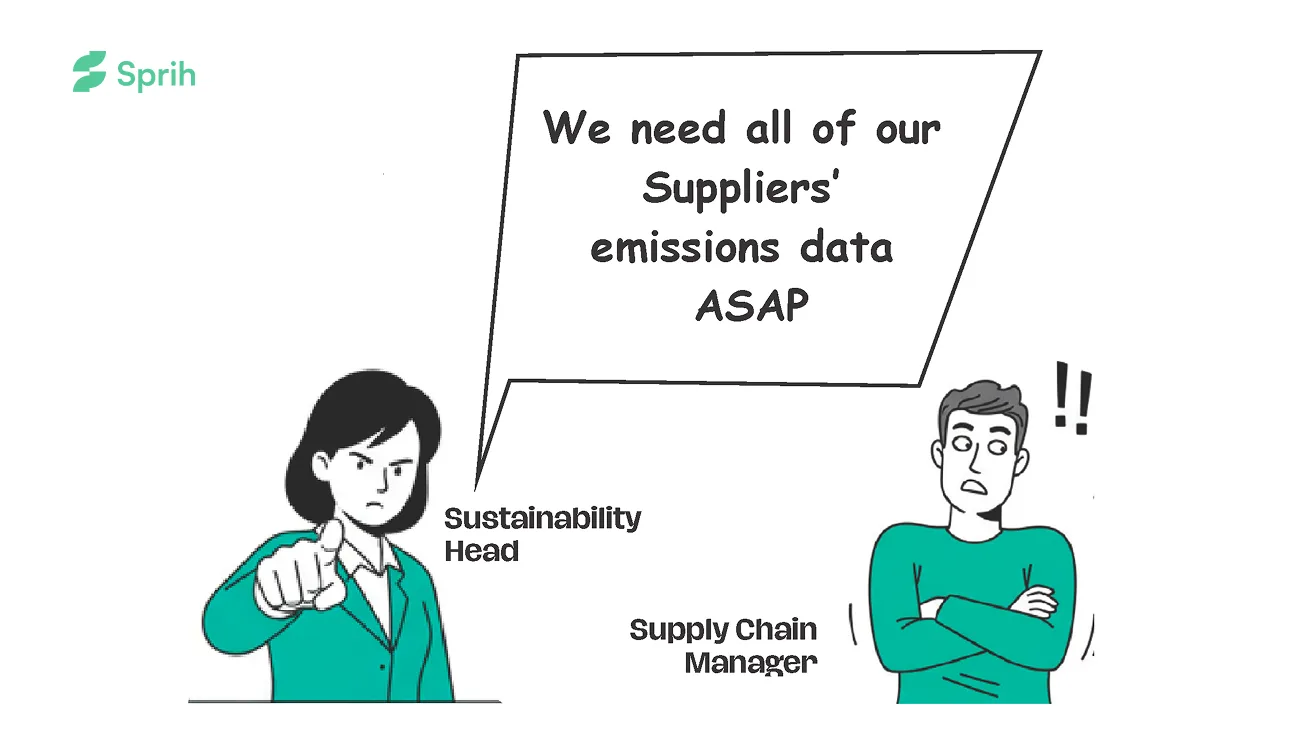

- Supply Chain Exclusion: Failure to provide emissions data can lead to being dropped by major clients with stringent sustainability targets.

- Competitive Disadvantage: Laggards risk losing out to competitors who can better attract investors, customers, and employees with strong sustainability credentials.

- Increased Costs and Market Access Limitations: Failure to meet evolving environmental standards can result in financial penalties, higher costs of capital, and even restricted access to certain markets due to regulations like carbon border taxes.

Tackling Scope 3 Emissions: A Key Reporting Challenge

A significant portion of the discussion focused on the complexities of Scope 3 emissions reporting. Given the intricate nature of global supply chains and the current lack of standardized data collection, this area presents a considerable hurdle. Here’s how you can stay ahead:

- Prioritize Impact: Focus on the most significant emission sources within the value chain.

- Engage Suppliers: Collaborate closely with suppliers, understanding their challenges and providing support for data collection.

- Leverage Technology: Utilize available software solutions to streamline data management.

- Adopt a Phased Approach: Start with readily available data and gradually refine reporting accuracy over time.

- Build Robust Processes: Invest in internal systems and cross-functional collaboration for effective data management.

Communicating the Value of Sustainability Reporting

Securing buy-in and resources for sustainability initiatives requires effective communication. The key is to frame the discussion in business terms, highlighting the tangible benefits related to risk management, cost savings, revenue generation, and competitive advantage. Aligning sustainability goals with core business priorities and demonstrating the value to various stakeholders – from customers to investors to employees – is crucial for gaining leadership support.

Leading the Way: California’s Role Sustainability Reporting

Currently, California is at the forefront of mandatory sustainability reporting in the US, with SB 253 and other related regulations setting the pace. New York is also poised to follow suit, indicating a growing trend towards state-level mandates. While the exact number of US companies currently reporting on sustainability metrics is still evolving, the direction is clear: increased transparency and accountability are on the horizon.

Conclusion: Prepare Now for a Sustainable Future

The message is clear: US companies must proactively engage with the evolving sustainability reporting landscape. By understanding the requirements of SB 253 and CSRD, embracing a strategic approach to compliance, and investing in robust data collection and reporting processes, businesses can not only meet regulatory demands but also unlock significant competitive advantages and contribute to a more sustainable future. The time to prepare is now, ensuring a smoother transition and a stronger, more resilient business for tomorrow.

Sprih simplifies the complexity of sustainability reporting with powerful tools for emissions tracking, supplier engagement, and Scope 3 data management. Whether you’re navigating double materiality or aligning with GHG Protocol standards, our platform empowers you to act with clarity, speed, and confidence.

FAQs

What is the main difference between SB 253 and CSRD?

California’s SB 253 focuses on GHG emissions reporting (Scopes 1, 2, and later 3), while the EU’s CSRD requires broader ESG disclosures using double materiality—how a company impacts sustainability and how sustainability impacts the company.

Why should US companies act now on sustainability reporting?

Acting early enables companies to streamline compliance, reduce operational risks, gain a competitive edge, attract ESG-focused investors, and avoid future penalties or market exclusions due to delayed action.

What challenges do companies face with Scope 3 emissions reporting?

Scope 3 reporting is complex due to supply chain data gaps and lack of standardization. Companies need to prioritize major emission sources, engage suppliers, and use technology and phased strategies to improve data quality.

How can companies gain strategic value from sustainability reporting?

Beyond compliance, sustainability reporting improves risk management, operational efficiency, brand reputation, and stakeholder trust—turning regulatory obligations into business opportunities.

What role is California playing in US sustainability regulation?

California leads with SB 253, setting a precedent for mandatory GHG emissions reporting in the US. Its actions signal a broader trend of increasing state-level environmental regulation and transparency expectations for businesses.